UAE Disburses $1 Billion Loan to Pakistan as IMF Forecasts Increase in External Debt

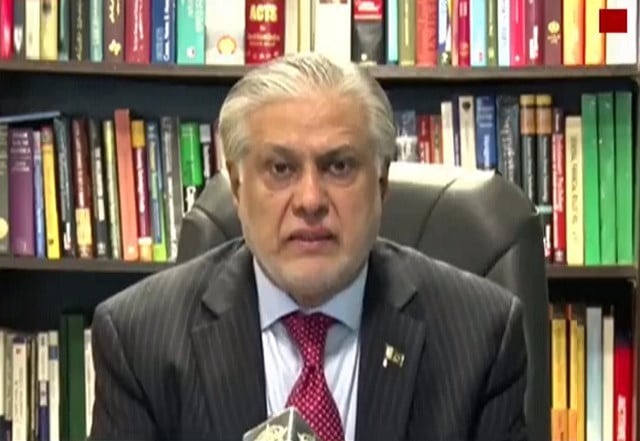

The United Arab Emirates (UAE) has extended a fresh loan of $1 billion to Pakistan, providing a much-needed boost as the International Monetary Fund (IMF) projects a significant rise in Pakistan’s external debt to $136.5 billion by the end of the fiscal year. This loan comes after the reopening of blocked financing pipelines, signifying an important milestone in the country’s financial stability.Pakistan’s Finance Minister, Ishaq Dar, announced the deposit of $1 billion by the UAE with the State Bank of Pakistan (SBP), bringing the UAE’s total exposure to $3 billion. This places the UAE third in terms of cash deposits, following Saudi Arabia with $5 billion and China with $4 billion in the central bank.The UAE’s deposit follows Saudi Arabia’s recent deposit of $2 billion with the central bank, as part of a deal with the IMF. Both Saudi Arabia and the UAE had withheld bailout funds until Pakistan returned to the IMF. With the recent staff-level agreement between Pakistan and the IMF, disbursements from both countries have now resumed.In parallel, the IMF has finalized its projections for Pakistan’s balance of payments in the medium term. Officials from the finance ministry indicate that the IMF expects Pakistan’s external debt stock to increase from an estimated $123.6 billion to $136.5 billion by June 2024.This projected $13 billion increase in debt stock is primarily attributed to high external debt repayment needs, financing of the current account deficit, and the requirement to increase foreign exchange reserves equivalent to 1.4 months of imports of goods and services. The IMF forecasts a slower pace of debt growth over the next four years, gradually reaching $153 billion by June 2028.These projections will be included in the Memorandum for Economic and Financial Policies document after the IMF approves the Stand-By Arrangement.The IMF has also projected a current account deficit of $6.4 billion for this fiscal year, equivalent to 1.8% of the Gross Domestic Product (GDP). Additionally, Pakistan faces $25 billion in debt repayments, while the government aims to secure $15 billion in debt rollovers.The annual gross financing requirements for the next fiscal year are estimated at $28.4 billion, covering the servicing of the current account deficit and debt repayments.Foreign exchange reserves, which stood at $4.5 billion at the end of the last fiscal year, are projected to increase to $9 billion in the next fiscal year. With the recent loans from Saudi Arabia and the UAE, reserves have risen to $7.5 billion, and an additional boost of $1.2 billion is expected next week.Finance Minister Ishaq Dar has stated that reserves will soon reach $14 to $15 billion, which matches the level when the coalition government came into power. However, it should be noted that private reserves, consisting of depositors’ funds, are included in this assessment.Sustainable foreign exchange reserves can only be achieved if receipts from exports, foreign direct investment, and remittances significantly exceed import requirements. However, the IMF projects a net foreign direct investment of only around half a billion dollars for this fiscal year.The IMF has also highlighted the external public debt, under the responsibility of the federal government, which is expected to reach $107.7 billion by the end of this fiscal year, marking an increase of nearly $11 billion within a year.The recent IMF program is expected to increase disbursements of foreign loans from multilateral and bilateral creditors, as Pakistan’s financing pipelines had dried up due to strained relations with the IMF.Regarding trade, the IMF does not anticipate a significant increase in exports for this fiscal year. While exports are projected to rise by 10% to $30.8 billion in 2023-24, the planning minister has expressed optimism, aiming for an increase to $35 billion for this fiscal year. Imports are projected to reach $64 billion, representing a 20% increase. However, there is a projected reduction of $1 billion in oil imports, totaling $15.4 billion for this fiscal year. The trade deficit is expected to reach nearly $34 billion, increasing by approximately $10 billion.Import growth is projected to slow down after this fiscal year due to limited capacity to finance imports given the thin foreign exchange reserves cover. The IMF forecasts workers’ remittances to reach $33 billion, a 22% increase compared to the last fiscal year.

Zjjdso

ivermectin canada – ivermectin 12mg stromectol order tegretol generic

January 2, 2025Viembo

buy isotretinoin 20mg without prescription – buy accutane generic linezolid tablet

January 13, 2025Pdcxhd

amoxicillin online order – valsartan 160mg tablet order combivent 100mcg online

January 13, 2025Yqpofj

oral zithromax – bystolic 20mg ca nebivolol 20mg sale

January 26, 2025Yvuljf

buy omnacortil 20mg for sale – buy progesterone progesterone us

January 29, 2025Loemvw

furosemide 40mg brand – buy betnovate 20gm without prescription3 buy betnovate 20 gm sale

February 7, 2025Eesusc

order vibra-tabs for sale – albuterol cheap glucotrol for sale

February 12, 2025Aybeep

augmentin 1000mg canada – how to get duloxetine without a prescription order duloxetine 40mg pills

February 13, 2025Cbhlcm

augmentin generic – purchase cymbalta for sale order generic duloxetine 20mg

February 20, 2025Cvnmwg

brand semaglutide 14 mg – cyproheptadine 4 mg cost purchase cyproheptadine pills

February 22, 2025Ptkuxm

purchase tizanidine sale – how to get tizanidine without a prescription hydrochlorothiazide over the counter

February 26, 2025Uuvici

order generic viagra 100mg – viagra 50 mg cialis next day

March 2, 2025Lqfkij

order cialis generic – cialis for sale overnight delivery for viagra

March 2, 2025Pbhjam

buy cenforce – glucophage 1000mg brand buy metformin 500mg sale

March 10, 2025Vyfznu

atorvastatin 80mg brand – zestril 5mg brand cost prinivil

March 12, 2025Enwwgd

prilosec to treat indigestion – lopressor tablet atenolol 100mg without prescription

March 19, 2025Hhrieh

methylprednisolone 16 mg over counter – buy aristocort generic order triamcinolone 10mg pills

March 25, 2025Bturva

clarinex pills – priligy 30mg drug buy dapoxetine 30mg

March 26, 2025Ognllo

cytotec cost – diltiazem online order diltiazem 180mg pill

March 29, 2025Vnhche

zovirax pills – buy acyclovir 400mg purchase crestor for sale

April 4, 2025Epcrfy

order motilium 10mg – buy sumycin generic flexeril pills

April 6, 2025Qqfqdl

domperidone 10mg canada – cyclobenzaprine 15mg usa buy cyclobenzaprine medication

April 13, 2025Cqbtcw

cheap inderal 10mg – methotrexate 5mg oral methotrexate where to buy

April 14, 2025Iqknvx

coumadin 5mg usa – buy generic cozaar online buy losartan 50mg pills

April 18, 2025Zrcjcu

buy esomeprazole for sale – buy sumatriptan generic sumatriptan 50mg canada

April 21, 2025Vwtzgq

levaquin for sale online – order avodart sale generic ranitidine

April 22, 2025Enbdhe

mobic 7.5mg pill – buy celebrex 200mg without prescription generic tamsulosin 0.4mg

April 28, 2025Ekrogx

zofran oral – order zofran sale brand simvastatin 10mg

May 15, 2025Ajaodo

cost valtrex – valacyclovir order online forcan oral

May 15, 2025vg9w9

provigil 200mg pill buy modafinil 200mg generic provigil 100mg price buy provigil generic provigil for sale buy modafinil 200mg for sale cost modafinil 200mg

May 30, 2025t5tp7

where to buy cheap clomid without prescription where to get clomid without prescription can i get cheap clomid no prescription where can i buy clomiphene without prescription how to buy cheap clomiphene tablets can you get clomid without rx get clomid for sale

June 6, 2025buy cialis cheap generic

Thanks on sharing. It’s acme quality.

June 9, 2025order cialis online pharmacy

Greetings! Jolly useful advice within this article! It’s the petty changes which wish espy the largest changes. Thanks a a quantity in the direction of sharing!

June 9, 2025does flagyl leave a metallic taste

I am actually thrilled to glance at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data.

June 10, 2025does flagyl need prescription

I couldn’t resist commenting. Well written!

June 10, 2025lzp8k

buy zithromax 250mg generic – zithromax 250mg usa buy flagyl 400mg pills

June 12, 2025cgixg

zithromax 250mg us – tinidazole 300mg us order flagyl 400mg generic

June 12, 2025