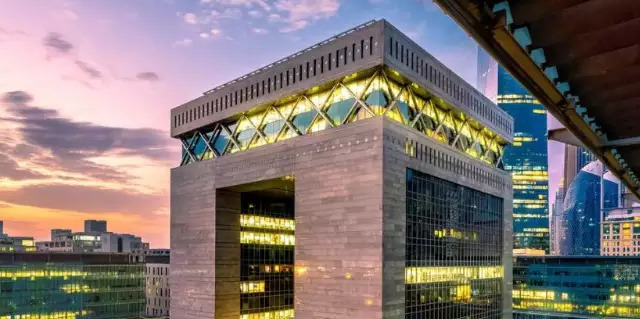

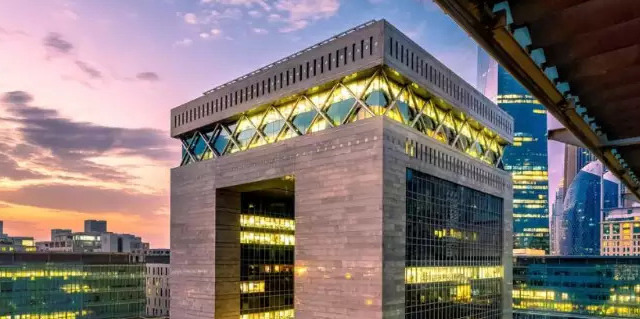

Dubai Financial Market Emerges as Global IPO Hotspot Amidst Market Turmoil

Despite several international stock markets experiencing their worst declines in almost a decade, the Dubai Financial Market (DFM) stood out as one of the most vibrant and active markets globally for initial public offerings (IPOs) and listings in 2022.

Throughout the year, five prominent issuers from both the Dubai government-related entities and the private sector successfully raised over $8.42 billion, creating a significant buzz in the investment landscape. These IPOs garnered remarkable oversubscriptions, with subscription amounts totaling an astounding $182 billion.

Dubai’s ability to maintain its momentum in IPO activity amidst global market turmoil is a testament to the region’s robust investment ecosystem and its reputation as a premier destination for capital raising. The successful IPOs and listings on the Dubai Financial Market have showcased the market’s resilience, attractiveness, and ability to draw global investment.

The surge in IPO activity has been driven by a combination of factors, including the region’s strong economic fundamentals, investor confidence in the UAE’s business environment, and the allure of tapping into the Middle East’s growing and dynamic markets.

The Dubai Financial Market has played a pivotal role in providing a platform for companies to access capital and expand their operations. The market’s solid regulatory framework, investor-friendly policies, and transparent trading practices have instilled trust and confidence among issuers and investors alike.

Moreover, Dubai’s strategic geographic location, world-class infrastructure, and diversified economy have positioned it as an ideal hub for businesses seeking to expand their footprint in the Middle East, Africa, and South Asia regions.

The Dubai Financial Market’s success in attracting international investment has not gone unnoticed, as it now presents a promising opportunity for Indian entrepreneurs looking to attract global capital. With its vibrant IPO market, the DFM offers Indian companies a viable route to access funding and expand their businesses on an international scale.

The accessibility and openness of the DFM provide Indian entrepreneurs with a platform to showcase their potential and attract investment from global institutional and retail investors. By listing on the DFM, Indian companies can gain exposure to a diverse investor base and tap into the liquidity offered by an active and dynamic market.

The collaboration between the Dubai Financial Market and Indian entrepreneurs has the potential to unlock new growth opportunities and strengthen bilateral economic ties between the two nations. Indian companies can leverage Dubai’s strategic location as a gateway to the wider Middle East market, while simultaneously benefitting from the region’s vibrant investment landscape.

As the Dubai Financial Market continues to thrive, it remains committed to supporting entrepreneurs and facilitating their access to capital. The market’s ongoing efforts to enhance its regulatory framework, attract top-tier companies, and foster an environment conducive to investment bode well for the future of IPOs and listings in Dubai.

In conclusion, amidst a tumultuous global market landscape, the Dubai Financial Market has emerged as a beacon of stability and success in the realm of IPOs and listings. The market’s ability to attract significant investment, even during challenging times, showcases its resilience and attractiveness as an investment destination. For Indian entrepreneurs seeking global investment opportunities, the Dubai Financial Market offers a promising route to access capital and expand their businesses in the international arena.

Ltohvo

cost of stromectol – order atacand pills buy tegretol without a prescription

January 2, 2025Liviwj

order absorica pill – zyvox 600mg brand buy zyvox 600mg pill

January 16, 2025Doukgb

oral amoxil – combivent canada ipratropium for sale

January 17, 2025Hplmes

order zithromax sale – cheap azithromycin 500mg order bystolic 20mg for sale

January 30, 2025Rtzwzc

buy prednisolone 40mg online – purchase prometrium for sale buy progesterone sale

February 1, 2025Jvfzkh

buy neurontin for sale – neurontin 600mg for sale order sporanox 100mg pills

February 9, 2025Rhbmpu

buy furosemide 100mg – order betnovate 20gm for sale3 buy betnovate 20gm

February 9, 2025Lpaxbu

where to buy augmentin without a prescription – order duloxetine 40mg order duloxetine 20mg without prescription

February 14, 2025Hkioan

buy acticlate online cheap – glipizide 5mg sale glipizide generic

February 16, 2025Qfcudl

buy amoxiclav for sale – cymbalta 20mg cost buy duloxetine 40mg generic

February 22, 2025Vwlfcs

buy rybelsus paypal – order semaglutide 14 mg generic order generic periactin

February 24, 2025Hhdpgx

order tizanidine online cheap – microzide cheap buy generic hydrochlorothiazide over the counter

February 27, 2025Iiubpz

tadalafil brand name – guaranteed cialis overnight delivery usa sildenafil for sale

March 5, 2025Rufhzc

viagra 50mg pill – sildenafil overnight shipping usa order cialis 20mg online cheap

March 6, 2025Yfatsz

buy lipitor 40mg online cheap – buy lisinopril 5mg generic prinivil ca

March 14, 2025Amtxex

oral cenforce 50mg – metformin 1000mg generic metformin 1000mg oral

March 16, 2025Temhzj

cheap omeprazole 20mg – lopressor over the counter tenormin 100mg usa

March 21, 2025Nvlmji

purchase depo-medrol pills – methylprednisolonee online purchase triamcinolone pill

March 26, 2025Plfbsx

desloratadine buy online – purchase claritin pills priligy 60mg cheap

March 28, 2025Potqia

cytotec 200mcg pill – diltiazem cheap buy diltiazem tablets

March 30, 2025Dctasr

buy zovirax 400mg pills – brand allopurinol purchase crestor for sale

April 5, 2025Etssbj

purchase domperidone online – buy domperidone generic flexeril 15mg uk

April 8, 2025Rykzkx

buy motilium – purchase domperidone sale order flexeril 15mg

April 15, 2025Mnhrav

inderal generic – plavix pills methotrexate 10mg cheap

April 16, 2025Xhuiog

warfarin cost – cozaar 50mg brand losartan 25mg canada

April 19, 2025Cvwzdt

order levaquin – buy avodart without a prescription generic ranitidine 150mg

April 23, 2025Khaetx

cheap esomeprazole – sumatriptan 25mg price buy generic sumatriptan

April 24, 2025Balipf

mobic 7.5mg ca – celecoxib us flomax pill

April 29, 2025Guljsc

order zofran 8mg – order aldactone online cheap purchase simvastatin online

May 16, 2025Zluuei

valacyclovir sale – buy diflucan 100mg for sale order diflucan 200mg generic

May 17, 2025aqxmo

buy modafinil online order modafinil 100mg pills buy provigil generic provigil order buy provigil generic order modafinil generic modafinil 200mg uk

June 1, 2025ancjx

where to buy cheap clomid without dr prescription can i purchase clomid without rx can i order generic clomiphene pills clomiphene tablete where to buy generic clomid no prescription cost of clomid without prescription how to get cheap clomiphene no prescription

June 6, 2025generic cialis sale

With thanks. Loads of erudition!

June 9, 2025order cialis with prescription

More posts like this would make the online elbow-room more useful.

June 9, 2025flagyl medication for dogs

This is a theme which is in to my verve… Diverse thanks! Exactly where can I find the acquaintance details for questions?

June 11, 2025generic name flagyl

This is the tolerant of enter I recoup helpful.

June 11, 2025hrqqp

buy zithromax sale – buy zithromax 500mg pill cheap flagyl

June 13, 2025s10p6

generic zithromax 250mg – order tetracycline 500mg generic oral flagyl 400mg

June 13, 2025wm621

rybelsus 14mg without prescription – cheap rybelsus 14 mg buy periactin 4 mg generic

June 14, 2025001q2

buy semaglutide 14 mg pills – buy semaglutide 14mg without prescription cyproheptadine 4mg pill

June 14, 2025sclv8

buy domperidone 10mg for sale – tetracycline 250mg usa flexeril online buy

June 16, 202503pyw

domperidone over the counter – buy sumycin 250mg cyclobenzaprine 15mg generic

June 16, 2025c7na0

cost propranolol – order plavix pills brand methotrexate

June 18, 2025y73le

propranolol brand – order clopidogrel 150mg online methotrexate 10mg brand

June 19, 2025