DAMAC, a UAE-based property developer, sold a $400 million Islamic bond.

DAMAC, one of the leading property developers based in the United Arab Emirates (UAE), has successfully sold an Islamic bond worth $400 million. The bond sale is seen as a positive development for the company, which has been facing a challenging market in recent years due to the impact of the COVID-19 pandemic.

The bond sale, which is expected to close in the coming weeks, will be used by DAMAC to refinance debt and finance new projects. The company was able to achieve a coupon rate of 4.25%, which is significantly lower than the 5.75% achieved when they last issued a bond in 2017. This highlights the successful financial manoeuvring by DAMAC in light of the current challenging conditions.

The Islamic bond, also known as sukuk, was issued by DAMAC Real Estate Development Limited and was heavily oversubscribed, reflecting strong demand from investors. The sukuk has a five-year tenor and carries a profit rate of 7.25%, which is considered attractive by industry standards.

The proceeds from the sukuk will be used to refinance existing debt and fund the company’s ongoing projects. DAMAC has a strong pipeline of developments in the UAE and other parts of the region, including luxury residential and commercial properties.

The successful issuance of the sukuk is a positive sign for the company, which has been facing a challenging market in recent years. The COVID-19 pandemic has had a significant impact on the real estate sector in the UAE, with demand for properties slowing down and prices falling.

DAMAC has also faced some internal challenges, including a drop in sales and a decline in profits. The company’s founder, Hussain Sajwani, has stepped down as chairman, and the company has been reorganizing its operations and cutting costs in response to the challenging market conditions.

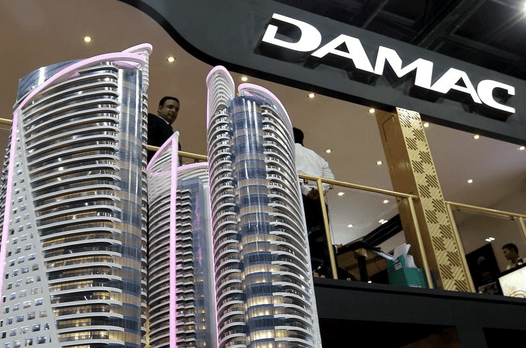

Despite these challenges, DAMAC remains one of the largest and most well-respected property developers in the UAE, with a strong track record of delivering high-quality developments. The company has a diversified portfolio of projects, including residential, commercial, and hospitality properties.

The successful sukuk issuance is a testament to the strength of the company’s brand and its ability to attract investors in a challenging market. The company’s management team has expressed confidence in the future, citing the strong demand for high-quality properties in the region.

The real estate sector in the UAE is expected to rebound in the coming years, with the government launching a number of initiatives to support the market. These initiatives include changes to residency laws, the introduction of new visa regulations, and the launch of a number of mega-projects, such as the Dubai Expo 2020.

These initiatives are expected to drive demand for high-quality properties in the region and could provide a boost to companies like DAMAC. The successful sukuk issuance is a positive sign for the company, and could help to position it for future growth and success.

In conclusion, DAMAC’s successful issuance of a $400 million Islamic bond is a positive development for the company and reflects strong demand from investors. The sukuk will be used to refinance existing debt and fund the company’s ongoing projects. Despite the challenging market conditions, DAMAC remains one of the largest and most well-respected property developers in the UAE, with a strong pipeline of developments. The successful sukuk issuance is a testament to the company’s strength and could help to position it for future growth and success.

We believe that the successful sukuk issuance is a positive step forward for DAMAC and highlights the company’s commitment to finance its projects in a cost effective manner. Going forward, we expect more activity from DAMAC as they continue to develop iconic real estate projects across the Middle East.

ใบปลิว

… [Trackback]

[…] Info to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

December 27, 2024คลินิกปลูกผม นครสวรรค์

… [Trackback]

[…] Here you can find 26776 more Info to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

December 27, 2024Ubet89 ทางเข้า เว็บตรง

… [Trackback]

[…] Here you will find 85433 additional Info to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

January 3, 2025Pharm1aceutics

… [Trackback]

[…] Information to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

January 10, 2025นักสืบ

… [Trackback]

[…] Read More on that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

January 21, 2025marine88

… [Trackback]

[…] Info to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

January 25, 2025HArmonyCa

… [Trackback]

[…] Find More on on that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

February 5, 2025สีพ่นรถยนต์

… [Trackback]

[…] Here you will find 97008 additional Information on that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

February 7, 2025bygge

… [Trackback]

[…] Read More here to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

February 25, 2025789bet

… [Trackback]

[…] Here you can find 69523 additional Information on that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

March 3, 2025Angthong National Marine Park

… [Trackback]

[…] Information to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

March 4, 2025เว็บสล็อตตรง ทรูวอเลท ไม่มีขั้นต่ำ

… [Trackback]

[…] Info to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

March 6, 2025Sayfaya git

… [Trackback]

[…] Read More here on that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

March 26, 2025fortune rabbit

… [Trackback]

[…] Info on that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

April 10, 2025developer official website

… [Trackback]

[…] Find More Info here on that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

May 9, 2025clash

… [Trackback]

[…] There you can find 20401 more Info to that Topic: ceoweeklyuae.com/damac-a-uae-based-property-developer-sold-a-400-million-islamic-bond/ […]

May 16, 2025