To enhance its fleet, AD Ports is planning to acquire eight new vessels for a total cost of AED 955 million.

Abu Dhabi Ports (AD Ports), the government-owned operator of ports and industrial zones in the United Arab Emirates, has announced its plan to expand its fleet by acquiring eight new vessels at a total cost of AED 955 million. The move is expected to boost the company’s capacity and further strengthen its position as a leading maritime trade hub in the region.

The eight new vessels will consist of four container ships and four bulk carriers. The container ships will have a capacity of 5,000 twenty-foot equivalent units (TEUs) each, while the bulk carriers will be capable of carrying up to 80,000 tonnes of cargo. The vessels are expected to be delivered between 2023 and 2024.

The acquisition of these vessels is part of AD Ports’ ongoing efforts to enhance its capabilities and expand its services to meet the growing demand for maritime trade in the UAE and the wider region. The company has been investing heavily in infrastructure and technology to ensure that its facilities are equipped with the latest and most advanced equipment and systems.

Captain Mohamed Juma Al Shamisi, Group CEO of Abu Dhabi Ports, said: “Our investment in these new vessels is a testament to our commitment to providing world-class maritime services to our customers. These vessels will enable us to enhance our capacity, increase our efficiency, and further strengthen our position as a leading maritime trade hub in the region.”

The acquisition of these vessels is also expected to create new job opportunities and support the growth of the maritime industry in the UAE. AD Ports is one of the largest employers in the country’s maritime sector, with over 2,500 employees working across its various ports and industrial zones.

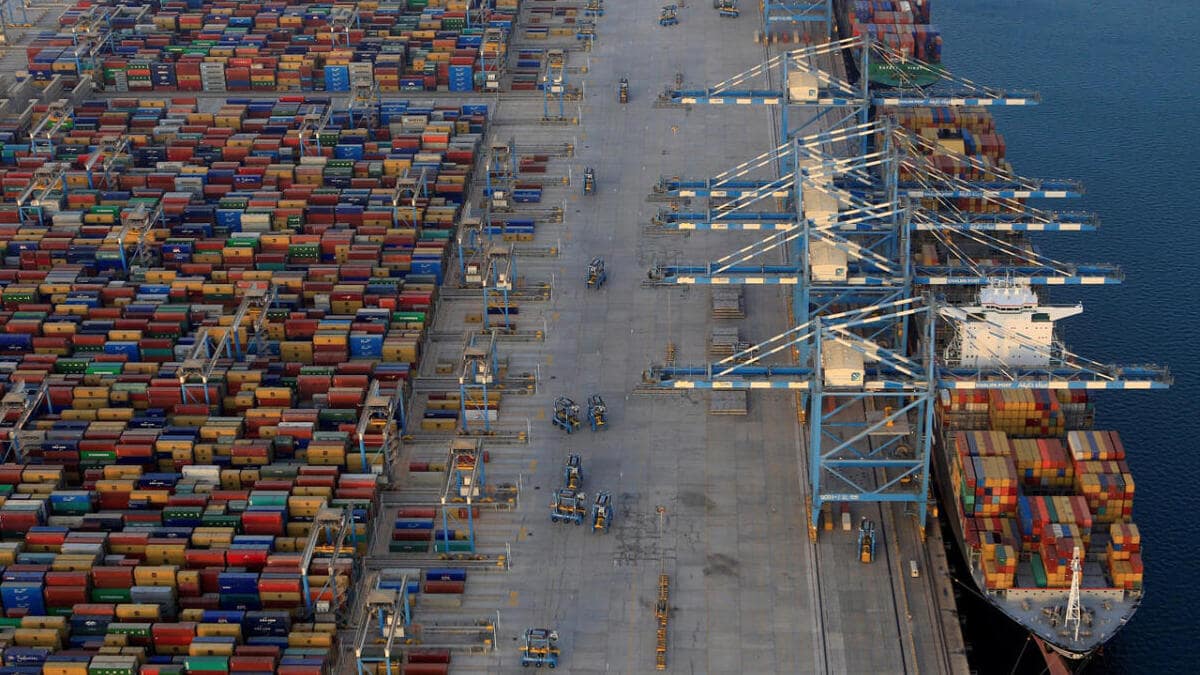

The company operates a total of 11 ports and terminals in the UAE, including the flagship Khalifa Port in Abu Dhabi, which is one of the most advanced and technologically sophisticated ports in the world. Khalifa Port has a capacity of 2.5 million TEUs per year and is capable of handling the largest container ships in the world.

AD Ports has been actively expanding its network of ports and terminals in recent years, both in the UAE and overseas. In 2020, the company signed an agreement with China’s Jiangsu Province to develop a new terminal at Khalifa Port for the handling of Chinese goods bound for the Middle East, Africa, and Europe. The terminal is expected to become operational in 2021 and will further strengthen AD Ports’ position as a key player in the global maritime trade.

The acquisition of the new vessels is also expected to support the UAE’s efforts to diversify its economy and reduce its reliance on oil and gas. The maritime sector is a key contributor to the country’s non-oil GDP, and the expansion of AD Ports’ fleet is expected to further boost its contribution to the economy.

The UAE government has been actively promoting the development of the country’s maritime industry, recognizing its potential to drive economic growth and create new job opportunities. The government has launched several initiatives to support the industry, including the establishment of the Emirates Maritime Arbitration Centre and the National Transport Authority.

In conclusion, the acquisition of eight new vessels by AD Ports is a significant development that is expected to enhance the company’s capacity and further strengthen its position as a leading maritime trade hub in the region. The move is also expected to support the growth of the maritime industry in the UAE and contribute to the country’s efforts to diversify its economy.