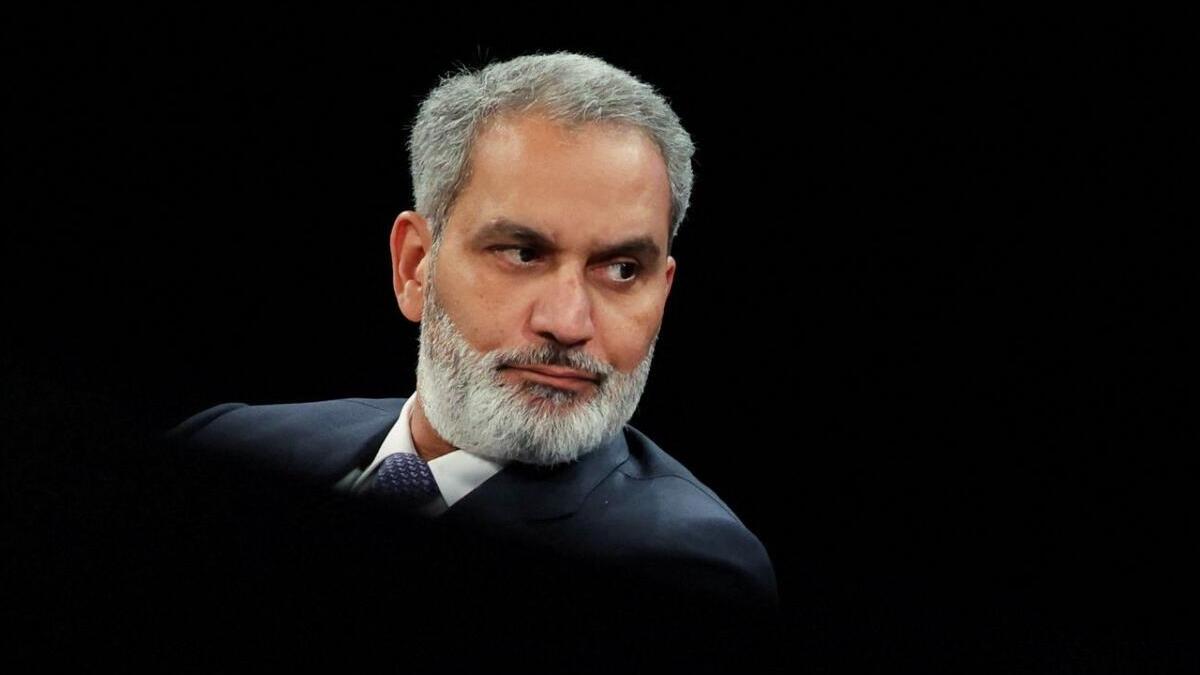

OPEC’s Secretary General recommends caution with regards to endangering significant oil investments by the IEA.

In a recent interview, the Secretary General of the Organization of the Petroleum Exporting Countries (OPEC), Mohammad Barkindo, has suggested that the International Energy Agency (IEA) should exercise caution and be extremely mindful when it comes to jeopardizing significant oil investments.

Barkindo’s comments come in response to the IEA’s recent report that called for an immediate end to new oil and gas exploration and production in order to achieve net-zero carbon emissions by 2050. The report, which was released earlier this month, has caused alarm among oil-producing countries, including those in the OPEC alliance, which rely heavily on the revenue generated by their oil exports.

Barkindo argues that the IEA’s report fails to acknowledge the significant investments that have already been made in the oil and gas sector, and that a sudden shift away from these investments could have dire economic consequences. “We have to be extremely mindful of the fact that the oil and gas industry is not just a commodity, it’s a major investment,” he said. “And we have to be extremely careful not to destroy this investment, which is the backbone of the global economy.”

Barkindo’s comments echo those of other industry leaders, who have argued that a sudden shift away from oil and gas could result in job losses, economic instability, and a loss of investment. They also highlight the tension between the need to reduce carbon emissions and the economic realities of the oil and gas industry.

The IEA’s report has been widely praised by environmental advocates, who argue that it represents a necessary step in the fight against climate change. However, it has also been criticized by some for its potentially damaging economic impact. Critics have argued that a sudden shift away from oil and gas could result in a spike in energy prices and a slowdown in economic growth.

Barkindo’s comments suggest that OPEC is not opposed to efforts to reduce carbon emissions, but rather believes that any such efforts should be made in a way that takes into account the economic realities of the oil and gas industry. He also suggests that there are alternative approaches to achieving net-zero emissions that do not involve a complete abandonment of the oil and gas sector.

For example, Barkindo points to the role that carbon capture and storage (CCS) technology could play in reducing emissions from the oil and gas sector. CCS involves capturing carbon dioxide emissions from power plants and other industrial sources and storing them underground. The technology is still in the early stages of development, but many experts believe that it could play a crucial role in reducing global carbon emissions.

Barkindo’s comments are likely to be welcomed by oil-producing countries, many of which have been hit hard by the decline in oil prices in recent years. However, they are also likely to be viewed with skepticism by environmental advocates, who argue that the continued reliance on fossil fuels is incompatible with efforts to address climate change. Regardless of one’s opinion, it is clear that Barkindo’s statements have put the spotlight on oil and its importance in the global economy. This could have significant implications for both producers and consumers in the coming years.

The debate over the future of the oil and gas industry is likely to continue in the coming years, as countries around the world grapple with the need to reduce carbon emissions while also ensuring economic stability. However, Barkindo’s comments suggest that there is a growing recognition among industry leaders that any efforts to address climate change must take into account the economic realities of the oil and gas sector.